does betterment provide tax documents

Betterment has calculated this for you based on your state of residence listed within your account. On the other hand Betterments returns have been massive over 100 since the companys founding in 2004 so maybe they are onto something.

Betterment Roi Sucks Feb 2018 To Mar 2021 R Financialindependence

Reporting Betterment Tax Form.

. When importing tax forms you will be able to deselect certain tax. Edit your portfolio strategy. Betterment provides all 1099 tax forms for you - 1099-B and 1099-DIV for taxable accounts and 1099-R and 5498 in May for IRA accounts.

The soonest you can start importing is Feb. Betterment Tax Forms. Choose from Broad Impact Social Impact and Climate Impact portfolios.

Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. If you have a personal and trust account. You will not receive a 1099-R for a direct trustee-to-trustee transfer from.

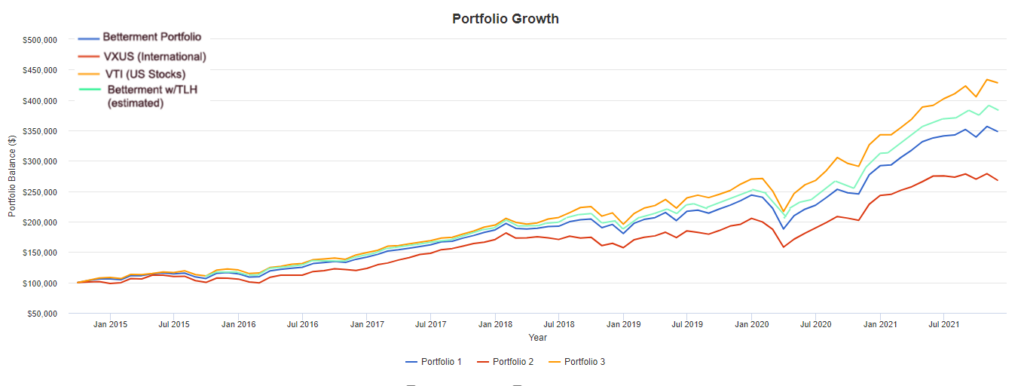

Tax loss harvesting TLH works by using investment losses to. Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as. Report Inappropriate Content.

You should be able to go to the Documents section within Betterment and print your quarterly statements to at least know your exposure to short-term gains and associated taxes. How much does Betterment charge in ACAT fee for full and partial IRA and taxable brokerage account transfer stock positions mutual funds and ETFs. Does betterment provide tax documents Saturday March 12 2022 Edit.

Somewhat pricey financial advisor consultations. Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. Simply head to the Documents section of your account and then click the Tax Forms.

There are three general tiers of costs but the costs change. Ad Align your values and investments with Betterments upgraded SRI portfolios. Choose from Broad Impact Social Impact and Climate Impact portfolios.

Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. Betterment does offer tax-loss harvesting automatically. It is able to provide market.

Note that we do not currently support integration with. Does Betterment Send Tax Forms 2022. View tax forms statements and other documents.

You have to enter them on your tax return. Tax-loss harvesting has been shown to boost after. With Betterment you can automatically import your tax information into TurboTax.

Betterment will send you. Only dividends and realized gains will have tax due. Just lump them together under a country.

Betterment has multiple pricing plans from fee-free plans to 04 annual fees. The 1099-B reports gains losses cost basis and. Ad Align your values and investments with Betterments upgraded SRI portfolios.

31 is the deadline for Betterment to provide Form 1099-R which reports distributions conversions and rollovers except direct IRA to IRA transfers from. Betterment also offers tax-loss. Betterment Digital provides automated portfolio management and charges 025 annually.

Betterments tax strategy is just fine but rival Wealthfront is among the robo-advisors with a more sophisticated tax strategy. For example if your account has about 5000 in it the Betterment fees will be only 1 monthly at a 035 annual price. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

The foreign taxes populate with the download but you have to manually enter the foreign source income total. Betterment Taxes Summary. A betterment is a specific type of project performed by a government entity that improves a specific area.

The forms 1099-B reports your sales of stocks in 2021. The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. Its up to you to decide for yourself.

Betterment is a clear leader among robo-advisors offering two service options. The no-fee plan costs 0 in fees and requires 0 in a minimum balance. Betterment provides automatic tax loss harvesting to all investors at no extra cost for Taxable accounts only.

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

6 Tax Strategies That Will Have You Planning Ahead

The Betterment Experiment Results Mr Money Mustache

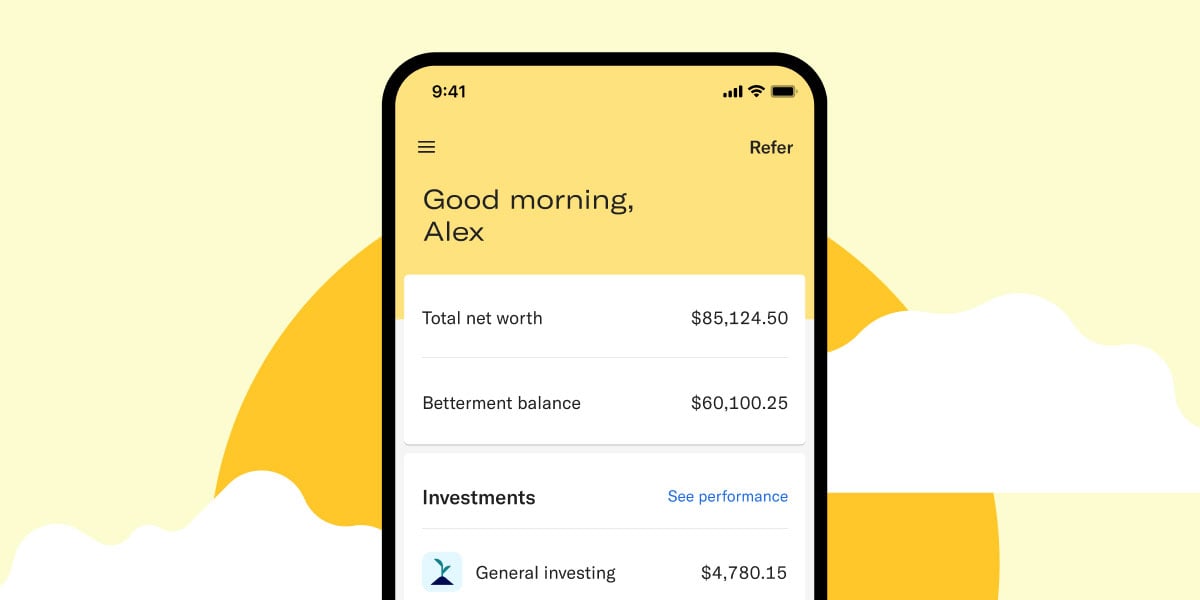

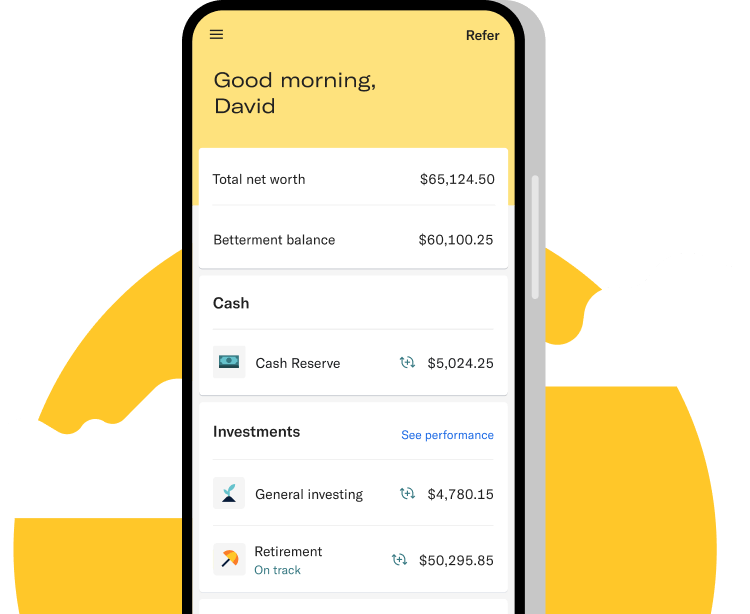

Betterment Mobile App Investing On The Go

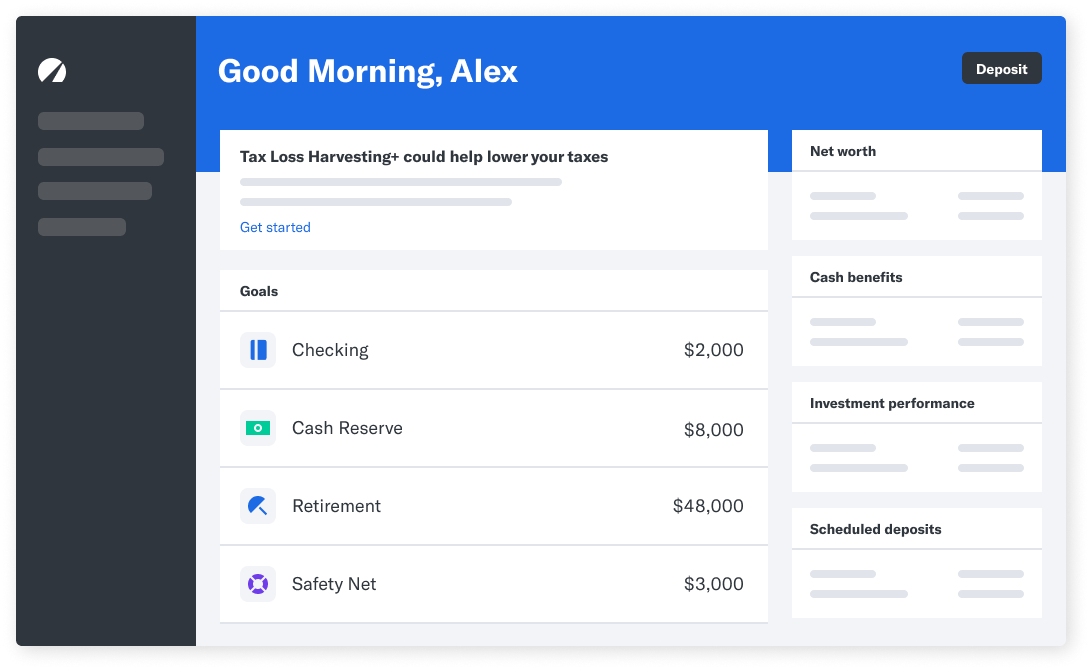

Using Investment Goals At Betterment

Betterment Sophisticated Online Financial Advice And Investment Management Investing Financial Advice Finance

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

Betterment Review Automated Financial Investment Robo Advisor Investing Financial Investments Portfolio Management

Betterment Retirement Income Retirement Retirement Advice

Betterment Sophisticated Online Financial Advice And Investment Management Investing Saving App Investment Tools

Betterment S Model For Financial Advice An Overview

Betterment Raises 160 Million In Growth Capital

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Season Calendar Tax Season Tax

/wealthsimple-vs-betterment-1c84228732c642fe91a5844e25b18589.jpg)

Wealthsimple Vs Betterment Which Is Best For You

/betterment_inv-f807c64202ac48a9a5a7dcfe4f2e6205.png)

/betterment_new_logomark-color-486b823c00444745b726163af424e476.png)

/betterment-vs-fidelity-go-3fea7f0f82c948ec863d1f114832ce95.png)